Life Insurance in and around Newaygo

Protection for those you care about

What are you waiting for?

Would you like to create a personalized life quote?

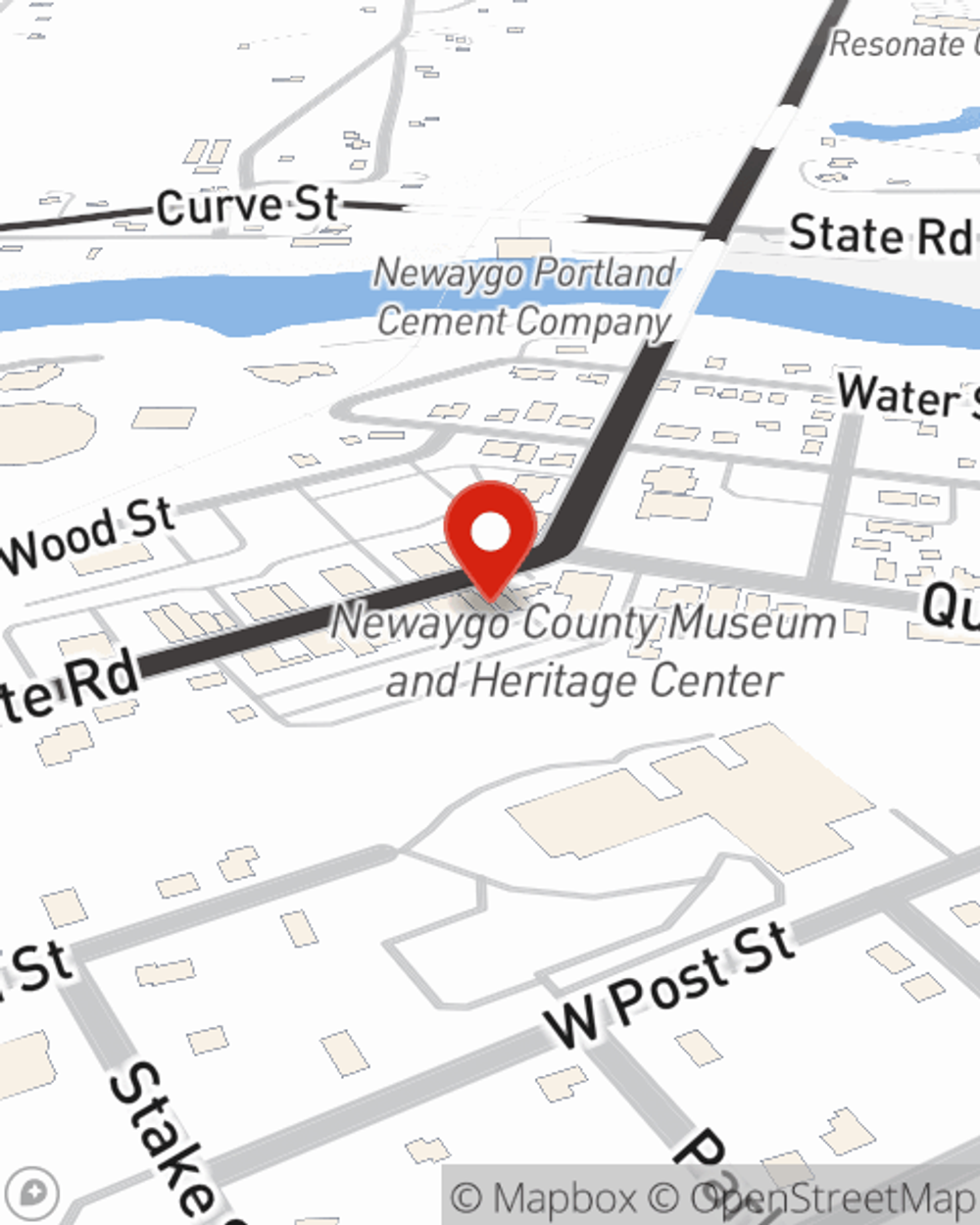

- Newaygo

- Fremont

- White Cloud

- Sand Lake

- Howard City

- Grant

- Kent City

- Big Rapids

- Twin Lake

- Grand Rapids

- Muskegon

It's Never Too Soon For Life Insurance

No one likes to focus on death. But taking the time now to arrange a life insurance policy with State Farm is a way to demonstrate love to your partner if you pass.

Protection for those you care about

What are you waiting for?

Life Insurance You Can Trust

Having the right life insurance coverage can help loss be a bit less complicated for your partner and provide space to grieve. It can also help meet important needs like medical expenses, ongoing expenses and your funeral costs.

When you and your family are insured by State Farm, you might sleep well at night knowing that even if something bad does happen, your loved ones may be covered. Call or go online today and see how State Farm agent Dave Oosterhouse can help meet your life insurance needs.

Have More Questions About Life Insurance?

Call Dave at (231) 652-1601 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

How much life insurance do I need?

How much life insurance do I need?

Here are some of the main factors to consider when you start thinking about the people & assets you want to protect & how long you want to protect them.

Dave Oosterhouse

State Farm® Insurance AgentSimple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

How much life insurance do I need?

How much life insurance do I need?

Here are some of the main factors to consider when you start thinking about the people & assets you want to protect & how long you want to protect them.